Profile 2023: An Economic Report on the Screen-Based Media Production Industry in Canada

HIGHLIGHTS FROM PROFILE 2023

Profile 2023 is the 27th edition of the annual economic report prepared by Nordicity for the Canadian Media Producers Association (CMPA) and its various project partners over the years. The CMPA’s project partners include the Department of Canadian Heritage, the Canada Media Fund, Telefilm Canada, and the Association québécoise de la production médiatique (AQPM).

Profile 2023 provides an analysis of economic activity in Canada’s screen-based media production industry during the period of April 1, 2022 to March 31, 2023. It also provides comprehensive reviews of the historical trends in production activity between the fiscal years of 2013/14 and 2022/23.

The complete report is available in English and French at https://cmpa.ca/profile

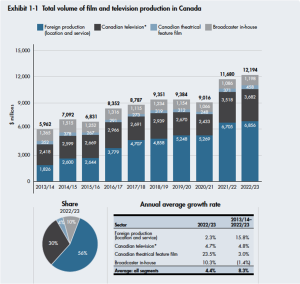

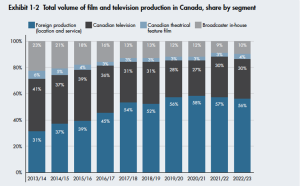

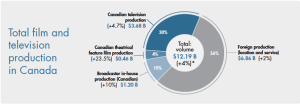

TOTAL FILM AND TELEVISION PRODUCTION IN CANADA

The film and television production industry in Canada consists of four key segments:

-

-

- Canadian Television Production segment

- Canadian Theatrical Feature Film Production

- Foreign Location and Service Production (FLS)

- Broadcaster In-house Production

-

Here are the topline figures for 2022-2023 at a glance:

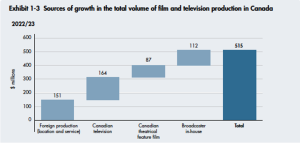

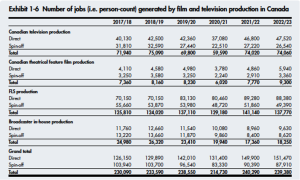

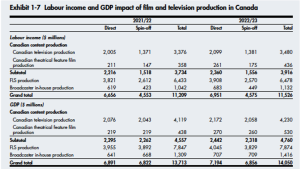

Total production volume in the Canadian film and television industry increased by 4.4% to $12.19 billion in 2022/23. Every segment of the production industry contributed to the growth, although a proportionately larger portion resulted from the production of Canadian-owned content, which increased by 6.5% to $4.14 billion. Factors affecting an increase in production volume included ongoing inflationary pricing, Canadian broadcasters continuing their required “catch up” on their underspend on Canadian programming during the pandemic period.

A financial summary like Profile is retrospective and includes information that may not reflect the state of the industry at the time of the publishing of the report. However, the current situation is unique, in that Profile 2023 does not reflect the systemic shocks which impacted the industry in 2023.

While production activity grew in the 2022/23 fiscal year, significant parts of the industry came to a grinding halt in the subsequent months. Two lengthy labour strikes in the United States interrupted production activity in Canada and around the world. That led to a significant decrease in production in Canada during the 2023/24 fiscal year. But that decrease and its impact on the Canadian production industry is not reflected in Profile 2023.

Ontario Creates provides summary production activity information on a calendar basis. Released on April 26, 2024, the summary for the 2023 calendar year indicates that production activity in Ontario decreased by a total of 42%, reflecting decreases in both Canadian-owned content 21% and foreign production (location and service) 55%.

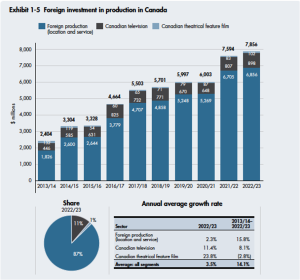

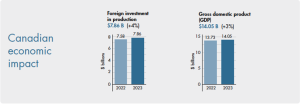

FOREIGN INVESTMENT IN PRODUCTION (FIIP)

Foreign investment in production (FIIP) tracks the value of international financial participation in the film and television production industry in Canada. A major portion of that investment is FLS production. However, along with FLS production, there are also significant foreign investments in the production of Canadian-owned content. These investments include foreign presales and distribution advances for all projects certified by CAVCO, as well as estimates of foreign presales and distribution advances for non-CAVCO-certified productions. Together, foreign investments in Canadian-owned content totaled about $1 billion.

FIIP excludes the amount of revenue earned from the distribution of completed Canadian films and television programs to foreign broadcasters and distributors. However, data published by Statistics Canada (and found in Section 8) indicates that these sales of completed content generated $100 million in 2021 (Exhibit 8 – 2), meaning that foreign investments in Canadian-owned content were even higher than $1 billion.

HIGHLIGHTS

- The value of foreign investment in production (FIIP) in Canada increased by 3.5% to $7.86 billion, including:

- $6.86 billion from foreign location and service (FLS) production, an increase of 2.3%

- $1 billion in financing (through various models) for Canadian-owned content production, an increase of 12.4%

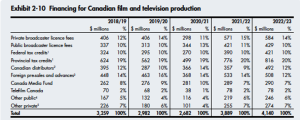

- Global studios and streamers account for 12% of total financing for Canadian-owned content production – making them one of the largest sources of financing. By comparison, the Canadian Media Fund accounts for 7% and Telefilm accounts for 2%.

The vast majority of FIIP is generated by English-language content. In fact, out of the $1 billion in FIIP generated by Canadian-owned content in 2022/23, French-language content accounted for only $24 million.

FOREIGN LOCATION AND SERVICE (FLS) PRODUCTION IN CANADA

The foreign production (location and service) (FLS) segment is primarily comprised of films and television programs filmed in Canada mainly by foreign producers with the involvement of Canadian-based service producers. This includes the visual effects (VFX) work done by Canadian VFX studios for foreign films and television programs. For the vast majority of FLS projects, the copyright is held by non-Canadian producers.

In recent years, Canada’s FLS production segment has contributed to numerous films released globally. Some recent Hollywood films that have either been shot in Canada or had their VFX work done in Canada include Dune: Part Two and Priscilla.

Canada has also become a destination for the filming of many television series commissioned by US networks or subscription video on demand (SVOD) services. Some recent series include The Good Doctor, Fargo and Star Trek: Strange New Worlds.

HIGHLIGHTS

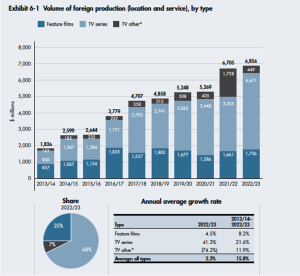

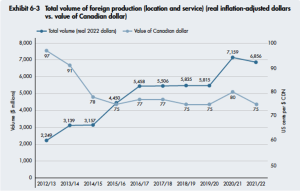

- The total volume of FLS production in Canada increased by 2.3% to an all-time high of $6.86 billion (56% of total production volume)

- FLS television series production increased by 41.3% to $4.67 billion.

- FLS feature film production increased by 4.5% to $1.74 billion.

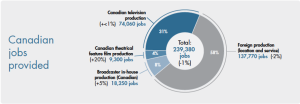

- FLS production accounted for 137,770 jobs (or 57.5% of total jobs) and contributed $6.5 billion in labour income.

The strong growth in Canada’s FLS production segment in recent years – including the rapid ‘catch-up’ in 2021/22 – has been supported by the continued global demand for original content, particularly from subscription video-on-demand (SVOD) services, such as Netflix, Amazon Prime Video, Disney+ and Apple TV+.

The production of other television content (i.e. television movies, specials and single-episode programming) – much of which would be destined for SVOD services – tripled in 2021/22 to $1.74 billion. However, in 2022/23 the production of this type of FLS content fell by 74.2% to $449 million, as the number of projects was practically halved from 216 in 2021/22 to 115 in 2022/23.

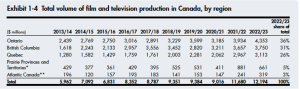

FILM AND TELEVISION PRODUCTION BY PROVINCE

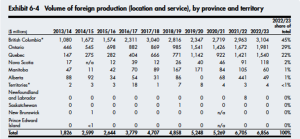

Unlike the broad-based regional growth in FLS production observed in 2021/22, the growth in 2022/23 was concentrated in certain provinces.

BRITISH COLUMBIA

- Total volume: $3.75 billion (31% of total share)

- FLS volume: $3.10 billion, a 4.8% increase (45% of total share)

- British Columbia was once again Canada’s leading province for FLS production.

ONTARIO

- Total Volume: $4.35 billion (36% of total share)

- FLS Volume: $1.98 billion, an 18.5% increase (29% of total share)

- Ontario experienced the largest gains in FLS production in Canada in 2022/23.

QUEBEC

- Total Volume: $3.11 billion (26% of total share)

- FLS Volume: $1.54 billion, an 8.4% increase (22% of total share)

- Quebec reached a record level of FLS production in 2022/23

NOVA SCOTIA

- FLS Volume: $118 million, a 29.7% increase (2% of total share)

- Nova Scotia vaulted past Alberta and Manitoba to become Canada’s fourth largest centre of FLS production in 2022/23

MANITOBA

- FLS Volume: $60 million, a decrease of 42.9% (1% of total share)

- Manitoba maintained its position as Canada’s fifth-largest centre for FLS production in 2022/23.

ALBERTA

- FLS Volume: $49 million, a 904% decrease (1% of total share)

- After more-than-quintupling to $492 million in 2021/22, the province’s total volume of FLS production dropped by nearly nine-tenths in 2022/23.

KEY CHARTS